Working out how much you need to save for retirement is a question that keeps many pre-retirees awake at night. Recent market volatility and fluctuating superannuation balances have only added to the uncertainty.

So it’s timely that new research shows you may need less than you fear. For most people, it will certainly be less than the figure of $1 million or more that is often bandied around.

For most people, the amount you need to save will depend on how much you wish to spend in retirement to maintain your current standard of living. One way of doing that is to look at how much you spend now.

When Super Consumers Australia (SCA) recently set about designing retirement savings targets they started by looking at what pre-retirees aged 55 to 59 are actually spending.

Retirement savings targets

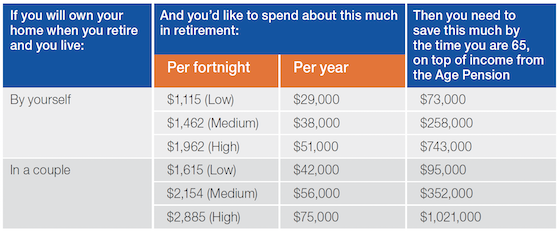

As you can see in the table below, SCA estimated retirement savings targets for three levels of spending – low, medium and high – for recently retired singles and couples aged 65 to 69.

Significantly, only so-called high spending couples who want to spend at least $75,000 a year would need to save more than $1 million. A couple hoping to spend $56,000 a year would need to save $352,000. High spending singles would need $743,000 to cover spending of $51,000 a year, and $258,000 for medium annual spending of $38,000.i

Table: Savings targets for current retirees (aged 65-69)

Source: Super Consumers Australia

While these savings targets are based on what people actually spend, there is a buffer built in to provide confidence that your savings can weather periods of market volatility and won’t run out before you reach age 90.

They assume you own your home outright and will be eligible for the Age Pension (which is reflected in the relatively low savings targets for all but wealthier retirees), and also make assumptions about future inflation and investment returns.*

Retirement planning rules of thumb

The SCA research is the latest attempt at a retirement planning ‘rule of thumb’. Rules of thumb are popular shortcuts that give a best estimate of what tends to work for most people, based on practical experience and population averages.

These tend to fall into two camps:

-

A target replacement rate for retirement income. This approach assumes most people want to continue the standard of living they are used to, so it takes pre-retirement income as a starting point. Once you have an income target you can work out the savings required to generate that level of income for the time you expect to spend in retirement. The government’s 2020 Retirement Income Review suggests a target replacement range of 65-75 per cent of pre-retirement income would be appropriate for most Australians.ii

-

Budget standards. This approach estimates the cost of a basket of goods and services likely to provide a given standard of living in retirement. The best-known example in Australia is the ASFA Retirement Standard which provides ‘modest’ and ‘comfortable’ budget estimates updated quarterly for changes in the cost of living.

SCA sits somewhere between the two, offering three levels of spending to ASFA’s two, based on pre-retirement spending rather than a basket of goods. Interestingly, the results are similar with ASFAs ‘comfortable’ budget falling between SCA’s medium and high targets.

ASFA estimates a single retiree will need to save $545,000 to live comfortably on annual income of $46,494 a year, while retired couples will need $640,000 to generate annual income of $65,445. This also assumes you own your home outright and will be eligible for the Age Pension.

Limitations of shortcuts

You may think these spending levels and targets are too low, or out of reach, depending on your personal circumstances and retirement goals. You may also query some of the underlying assumptions, especially if you rent or don’t own your home outright and expect to retire with a mortgage or other debts.

The big unknown is how long you will live. If you’re healthy and have good genes, you might expect to live well into your 90s which may require a bigger nest egg.

If for whatever reason you think your super nest egg is too small for comfort, it’s never too late to give it a boost. You could:

-

Ask your employer to put a salary sacrifice arrangement in place or make a personal super contribution and claim a tax deduction, being mindful to stay within the annual concessional contributions cap of $27,500.iii

-

Make an after-tax super contribution of up to the annual limit of $110,000, or up to $330,000 using the bring-forward rule.iv

-

Downsize your home and put up to $300,000 of the proceeds into your super fund (up to $600,000 for couples).v

Thanks to new rules that came into force on July 1, you may be able to add to your super up to age 75 even if you’re no longer working. As with everything to do with super, strict rules and eligibility hurdles apply so ask us about the most appropriate strategies for your situation.

While retirement planning rules of thumb are a useful starting point, they are no substitute for a personal plan. If you would like to discuss your retirement income strategy, give us a call on 03 9038 9449.

*Assumptions include average annual inflation of 2.5% in future, which is the average rate over the past 20 years, and average annual returns net of fees and taxes of 5.6% in retirement phase and 5% in accumulation phase.

i https://www.superconsumers.com.au/retirement-targets

ii https://treasury.gov.au/publication/p2020-100554

Important: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.