The main benefit of borrowing through your Self-Managed Super Fund (SMSF) is that an asset can be bought, which the SMSF could not otherwise afford given its current level of assets. Capital gains are multiplied if the asset rises in value, but the tax on that capital gain will be reduced or even eliminated by using the super environment.

However, borrowing through your SMSF is not as straightforward as borrowing outside it, as there are a number of rules and conditions that need to be met. As such, we suggest that you think carefully before embarking on a borrowing strategy through your SMSF and discuss this fully with your Financial Adviser.

Background

Self-Managed Super Funds (SMSFs) are generally restricted from borrowing except in limited circumstances. An exception to this is where a limited recourse loan is used. A “limited recourse loan” is one where the lender is only able to make claims against the asset that is being purchased; none of the other assets of the SMSF are at risk.

This has the effect of protecting the other assets within the SMSF, which is effectively your retirement savings. But this also means that only the asset being purchased can be used as security for the loan, unless you are willing to use assets held outside the SMSF.

What can the borrowing be used for?

There are limits on what SMSFs can use borrowed funds for. The first thing to note is that a SMSF can only borrow to purchase a new asset, that is, an asset not already owned by the SMSF. As such you cannot use existing assets of the SMSF as security.

Secondly, the asset must be one which the SMSF is permitted to acquire and hold. For example, you are not able to purchase a residential property from a member or related party of the SMSF, or invest in a golf club membership. But you can purchase a new investment property or business real property from a member or related party.

The final thing to take into account is that the borrowing must be used to acquire a single acquirable asset. This includes a property, a managed fund or a parcel of direct shares in the same company, for example $50,000 of BHP shares. However, a diversified parcel of shares is not considered a single asset, for example a parcel containing $10,000 BHP shares, $10,000 ANZ Shares and $10,000 QBE shares would not be considered a single acquirable asset. A managed fund containing a number of different shares is a single acquirable asset.

When considering whether to purchase property you need to ensure that the property is on a single title, otherwise you may need multiple loans. Common examples are where a property is held on multiple titles, or if a parking space was held on a separate title. As this is a complex area, a number of examples provided by the Australian Taxation Office can be used to assist in determining if the asset is a single acquirable asset.

There is also a requirement that while there is a borrowing in place, the SMSF cannot “improve” the asset. However, the asset can be repaired. If you are planning on making any changes or repairs to the asset, please speak to your financial adviser and provide them with as much detail as possible. They will then work with you to ensure the borrowing is structured in the right way, to allow these changes to occur, or to explain why what you are proposing is not able to go ahead.

Let’s look at some examples

Gary and Meg have their own SMSF. They own a residential investment property in their own name which they would like to transfer into the SMSF. They are unable to do this as the SMSF is prohibited from acquiring residential investment property from the members of the SMSF.

After discussions with their financial adviser they then decide to purchase a new investment property in the name of the SMSF. This asset is able to be purchased, and the SMSF could borrow to help fund the purchase.

Eric runs a small Accounting practice and owns the property where he runs the practice. Eric wants to transfer the property into his SMSF. Eric is able to do this as the property is used solely for his business and meets the definition of business real property. The SMSF could also borrow to help fund the purchase from Eric.

How is the loan structured?

There are a number of conditions that must be met for the borrowing to comply with the rules:

- The borrowing is by the trustee of the SMSF.

- The asset is held by a trust so that the SMSF receives a beneficial interest and a right to acquire the legal ownership of the asset (or any replacement) through the payment of instalments. In other words, what is often known as a bare trust is established within the SMSF, and the asset is held within this bare trust. When the loan is repaid in full, the asset transfers out of the bare trust into the name of the SMSF.

- The SMSF trustee has a right, but not an obligation, to acquire legal ownership of the asset by making one or more payments.

- You can either use a third party, such as a bank or other financial institution, or a related party such as a SMSF member or related entity to provide the loan.

Example

Fred and Sarah, both aged in their early 40’s are members of their SMSF. The fund currently has $550,000 of assets invested across cash, fixed interest, equity and indirect property investments. Fred and Sarah have found a residential investment property which they wish the SMSF to purchase from an unrelated third party for $500,000. They plan to rent out the property to another unrelated third party.

The SMSF has a few options when it comes to purchasing the property. It could purchase the direct property outright, by selling the assets of the fund, but this would leave the SMSF heavily weighted towards direct property.

It could purchase the property jointly with Fred and Sarah as tenants in common. Or it could borrow part of the purchase price for example, by investing $200,000 in a related instalment trust and the remaining $300,000 plus costs is borrowed by the SMSF to purchase the property.

The SMSF receives the rental income, which is taxable to the fund.

Over time, the SMSF will make payments (instalments) to reduce and eventually payout in full the amount owed, plus interest payments.

When the borrowings are fully repaid the legal title of the property will pass to the SMSF.

If the SMSF defaults on the loan, the rights of the lender are limited to the asset which is subject to the borrowing – in this case the investment property. The SMSF’s loss is limited to the loss of the beneficial interest in the asset and the instalments paid prior to default.

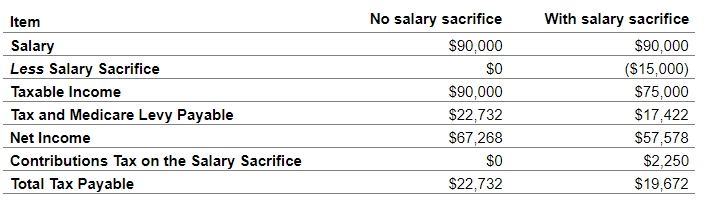

As illustrated, Adam can salary sacrifice an additional $15,000 into super and he will save $5,310 in personal income tax ($22,732 minus $17,422). When the additional contributions tax is taken into account his tax saving has reduced to $3,060 ($22,732 minus $19,672).

However, Adam’s take home pay has only reduced by $9,690 ($67,268 minus $57,578) while his super balance has increased by $12,750 after taking into account the contributions tax payable ($15,000 minus $2,250).

This achieves his objective of growing his retirement savings.

As you can see, if Adam continued to salary sacrifice into super up to retirement he will greatly increase his super balance, providing him with the potential for a much greater quality of life in retirement.

Instead of salary sacrificing how else can I get the same benefit?

As discussed above, some employers limit the amount you can salary sacrifice into super or don’t allow you to get the full benefit. Instead of salary sacrificing into super, you can now contribute money from your bank account and claim a tax deduction.

The advantages of doing this are that you are able to contribute as much as you are able to afford, up to your cap of $25,000. You could consider keeping the money in your offset account, to reduce the interest on your mortgage and then in June withdraw the money and contribute it into super.

You need to lodge a form (A notice of intent to claim a tax deduction) to ensure you get the tax deduction, but your adviser can help you.

This also means that you can contribute payments that you may not be able to salary sacrifice, such as bonuses and leave payments.

We recommend you talk to your adviser.

Advantages of borrowing through your SMSF

The list below covers some of the advantages of borrowing through your SMSF:

- You are able to purchase an asset which the SMSF otherwise could not afford. By borrowing funds you are able to purchase assets now, instead of having to wait years to be able to afford them.

- Capital Gains tax (CGT) is minimised as SMSF’s pay tax at a maximum rate of 15%, and if sold when the SMSF is in pension phase, the CGT could be reduced to nil.

- If you are a small or medium sized business, you may be able to own your business premises through your SMSF. This gives you control, and also means that the rental income is received by the SMSF which will pay tax at a maximum of 15%, and can be used to fund your retirement.

- You can use your contributions to pay down the debt faster.

- As the maximum tax rate in the SMSF is 15%, the investment earnings will be taxed at a reduced rate, as compared to you holding the same asset outside of super. In other words, the rental income on the property will be taxed at a maximum rate of 15% as compared to up to 45% (plus Medicare levy) if held in your personal name.

- You can use your existing super savings to help fund the purchase, thus reducing the amount you need to borrow.

- You may be able to reduce tax on other income within the SMSF. The net loss resulting from a negatively geared investment can be applied against other assessable income of your SMSF such as personal concessional and employer contributions. Depending on the size of the loss, the tax rate paid on your concessional contributions can fall below the already concessional rate of 15% (or 30% if your income and contributions are over $250,000).

- The contribution caps effectively limit the amount of money you can accumulate within your SMSF’s concessional tax environment. If you are nearing or have already reached your contribution limits, gearing within your SMSF can help to increase your SMSF’s asset base.

Things to consider when borrowing through your SMSF

- Understand the strict borrowing laws. If the loan including the documentation is not set up properly, or you borrow against an asset that your SMSF isn’t allowed to hold, then you could be up for penalties or be audited by the ATO. An even worse consequence could be having to unwind the transaction, whereby the SMSF and/or the member incurs selling and other costs.

- That you have a strategy in place to repay the loan over time. How are you going to fund the loan repayments, will you use contributions into the fund, or income the asset is producing? What happens if the asset doesn’t produce any income, for example, it is a rental property and you can’t find a tenant? What happens if one of you were to die?

- That the tax advantages may be higher by holding the asset outside of super due to the lower tax rate in super. If you borrow outside of super you will get a tax deduction on the interest on the loan at your marginal tax rate which could be as high as 45% (plus Medicare levy). Compare this to the maximum tax rate of 15% inside super. If the fund is in pension phase, then the tax rate is 0%.

- The additional costs required to set up the borrowing properly. There will generally be additional fees to cover the loan documentation. You will also need to set up the bare trust.

- That your SMSF is still invested in a diversified portfolio of assets, and not invested solely in one geared asset. Just because the lender cannot make a claim against the other assets of the SMSF in the event of default, doesn’t mean that your overall retirement savings are immune from loss. Also, if your SMSF is tied up in one large asset, will it be able to pay pensions when the time comes?

- Borrowing to invest magnifies both the potential for gains and losses. Even though the lender’s recourse is limited to the asset acquired, ultimately, if the value of your SMSF’s investment drops, or if your SMSF is unable to make repayments and the lenders foreclose, your SMSF still stands to make a loss.

- If the SMSF members are approaching retirement, you should consider if borrowing is an appropriate strategy. Most investors want to clear debts before retirement, plus regular contributions may no longer be made. Typically investments are bought for the medium to long term, especially if geared. Is this appropriate on the eve of retirement?

- If a small business owner transfers their business premises into their SMSF, while there are many advantages, you also need to consider what would happen if the business failed for any reason. In this case it is unlikely that contributions would occur, and the business premises may not be able to be rented out, or sold.

- Be aware of providing a personal guarantee. If the SMSF is unable to make the loan repayments, then your personal assets could be at risk.

- If using a bank or other financial institution to arrange the loan and documentation always employ your own legal team, even if it is suggested and more cost effective to use theirs.

- Is the borrowing in the member’s best interests? If not, then you should consider a different less risky strategy.

- The LRBA will impact your “Transfer Balance Cap” and “Total Super Balance” amounts. We recommend you seek further advice on this area.

Steps to setting up a Limited Recourse Loan Arrangement

- Establish the SMSF, or if you have an existing SMSF ensure that the trust deed allows the fund to borrow, and that the asset you want to purchase is allowed under the Superannuation Industry (Supervision) Act and in line with the fund’s investment strategy

- Identify the asset for purchase

- Establish the “Bare Trust” – usually with the aid of a specialised lawyer

- Choose a lender

- Purchase the asset using money from the SMSF and the borrowed funds (Do not use any personal money)

- Arrange the loan agreement and mortgage upon settlement

We recommend that you seek independent Tax and Legal Advice before entering into a gearing strategy, and that you as trustees understand the risks and issues of introducing gearing into your SMSF.