The Government has introduced a new policy that enable the retirees to move out of large houses by downsizing (selling) the family home and top up their retirement savings. From 1 July 2018, Australian’s whom are 65 years or older can sell their main residence and then make a downsizer contribution into their superannuation account of up to $300,000. This means a couple can increase their superannuation benefits by up to $600,000.

How does this work?

- You are required to be 65 years or older at the time of the contribution.

- You need to have owned the property for at least 10 years, and this must have been the main residence (family home) in which you resided in.

- The contribution must be sourced from the sale proceed of the main residence.

- The contribution must be made within 90 days of the change of ownership.

- Unlike the after tax (non-concessional) contribution cap, you do not need to meet the work test to make a downsizer contribution.

What is the benefit?

Beneficial tax environment

By investing the sale proceeds in the superannuation, this allows you to invest in a concessional tax environment. This potentially allows for tax free investing and returns, which may help increase the longevity of your investments in retirement along with the earnings.

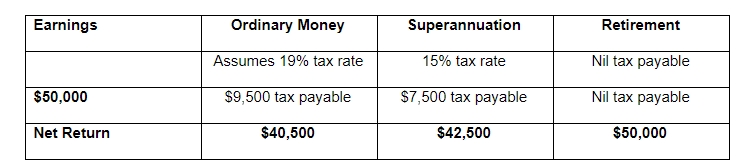

The table below shows the potential net return on investment outside super compared to in super environment and retirement phase.

Based on investment earnings of $50,000, you could save $2,000 pa in tax if the funds are invested in the super environment, or $9,500 pa if held in the retirement (income) phase.

You can exceed the $1.6M total superannuation balance restriction

Since 1 July 2017, an individual with total superannuation balance of $1.6 million or more is unable make after tax (non-concessional) contributions to a super account. This is a great opportunity to contribute additional fund towards their retirement.

Purchasing a new home

When making a downsizing contribution to superannuation (from the sale of your family home), you are not required to purchase a new home.

What are the disadvantages?

Transfer cap to retirement

There is a $1.6M balance transfer cap when moving funds from superannuation to retirement phase income streams. This means if your downsizing contribution brings your balance above $1.6M you will be required to retain a portion of your funds in superannuation phase (whereby earnings are taxed at up to 15%, as opposed to the tax free retirement income phase).

Centrelink

As the downsizing contribution will form part of your retirement funds balance, these will become assessable towards Centrelink benefits (asset and income test). As you will be moving money away from a non-assessed asset (family home) into an assessable asset (superannuation/retirement income stream) this may affect your overall Centrelink entitlement.

Transactional costs

When buying and selling property there are additional costs to consider, these include but are not limited to stamp duty, legal and land taxes.

To work out how this could help boost your retirement we recommend you talk to your adviser.